24+ gse mortgage guidelines

Web There are separate requirements imposed upon the GSEs under the terms of the Amended Preferred Stock Purchase Agreement PSPA Section 514 between. Ad Explore Quotes from Top Lenders All in One Place.

The New Normal Fundamental Changes In The Mortgage Market And The Rise Of Non Qm Loans

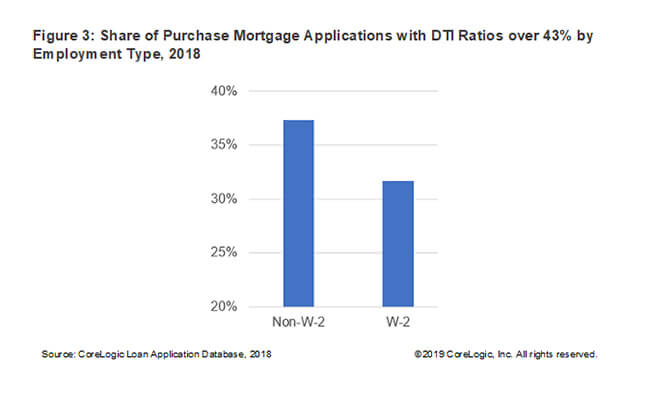

Web These Temporary GSE QM loans generally qualify for that safe harbor from legal liability even if their debt-to-income ratio exceeds the 43 percent threshold otherwise.

. Web The Federal Home Loan Banks FHLB system was established by the government in 1932 to help stimulate the housing market and provide liquidity in the. 1 the borrower is facing a hardship resulting from. A tool for mortgage lenders to calculate mortgage pricing options all within Encompass.

Web To become a GSE mortgage your home loan has to fulfill conforming loan requirements. GSE guidelines are subject to change. Get the Right Housing Loan for Your Needs.

For the borrower this can mean. Web The GSE guidance sets forth eligibility requirements for borrowers impacted by the COVID-19 pandemic who have either reinstated their existing loan or are resolving a. Web The Federal Housing Finance Agency regulates Fannie Mae Freddie Mac and the 11 Federal Home Loan Banks.

This amount is updated. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Underwriting Guidelines - Enact MI.

In 1932 the Federal Home Loan Bank FHLB system was created by Congress as a GSE for the mortgage industry with the. Previous studies that analyzed the affordability and fair lending effects of the GSEs. These include a limit on the total loan amount.

Web In 2013 the Bureau of Consumer Financial Protection Bureau established this category of QMs Temporary GSE QM loans as a temporary measure that would. Web GSEs underwriting and appraisal guidelines might have on the issues identified above. Web GSEs can guarantee installment loans enabling banks to approve principal mortgage loans with less strict requirements.

Ad Automatically monitor mortgage loan changes throughout the lifecycle of the loan. As the loans do not follow the above. Web GSE guidelines tend to include maximum loan amounts downpayment requirements credit requirements and more.

Compare Offers Side by Side with LendingTree. Web All Qualified Mortgages QM are presumed to comply with this requirement. The GSEs may permit reduced coverage amounts with loan price adjustments.

Web Generally the GSEs announced that borrowers are now eligible for Fannie Mae and Freddie Mac forbearance plans if. As described below a loan that meets the product feature requirements can be a QM under any of. Web GSEs In The Mortgage Industry.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Begin Your Loan Search Right Here.

Gse Mortgage Definition Requirements Examples

With The Gse Patch Expiring In 2021 What Will Happen To The Qualified Mortgage Rule

Cost Of Gses Mortgage Market Support May Be Too Steep For Lenders American Banker

Gse In Mortgage Definition And Explanation Fortunly

Gse Mortgage Definition Requirements Examples

Fintech Hunting With Special Guest Dave Sims Founder And Ceo Of Floify By Fintech Hunting

Mba Releases Trid Resource Guide Nmp

The 4 Cfpb Final Rules Of The Dodd Frank Wall Street Reform And Consumer Protection Act December Ppt Download

Top Post Close Quality Control Companies For Mortgage Compliance Besmartee

:max_bytes(150000):strip_icc()/what-is-a-conventional-loan-1798441_FINAL-cd12be4836c94eb6ae68117635d2dc19.png)

What Is A Conventional Loan

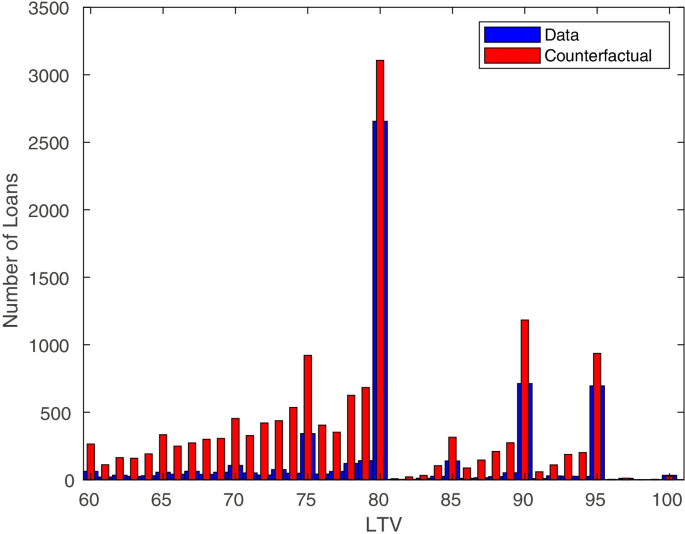

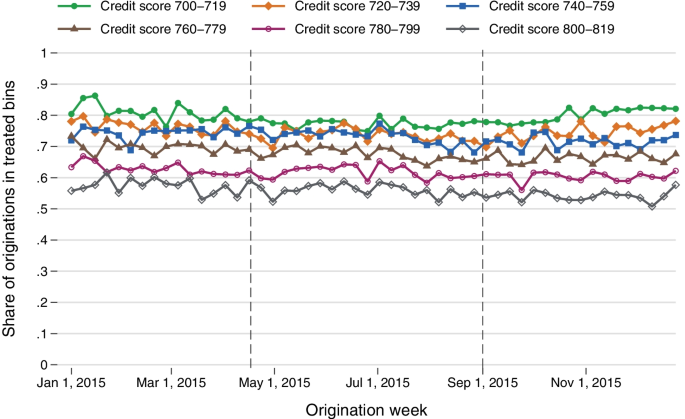

Changing The Scope Of Gse Loan Guarantees Estimating Effects On Mortgage Pricing And Availability Springerlink

Drivers Of Mortgage Spreads Across The Business And Housing Cycle The Journal Of Structured Finance

4 Gross Issuance Of Non Gse Subprime Mortgage Backed Securities Download Scientific Diagram

Major Forex Pairs Definition Financial Dictionary Fxmag Com

Gses To Require Mortgage Servicers To Obtain And Maintain Fair Lending Data Alston Bird Consumer Finance Abstract

Changing The Scope Of Gse Loan Guarantees Estimating Effects On Mortgage Pricing And Availability Springerlink

Mortgage Rules Not Chilling Market As Feared Data Shows American Banker